How U.S. Mining in Ukraine Could Impact the Metal Recycling Industry

Date

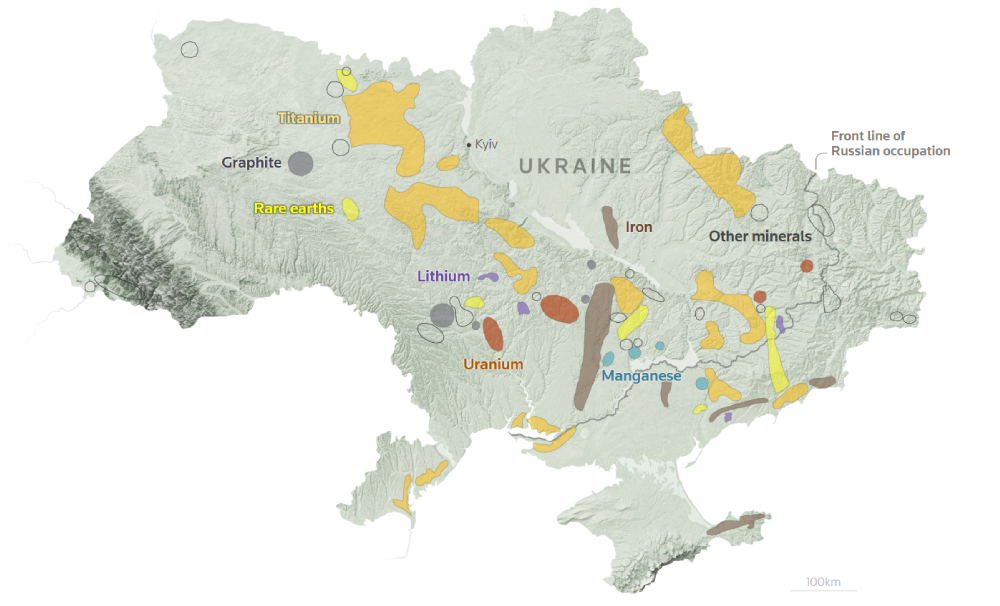

Mineral Map of UkraineSource: www.reuters.com

Ukraine’s Minerals and the Changing U.S. Scrap Market

The potential agreement between the United States and Ukraine to mine critical minerals, including tantalum and other rare earth elements, presents both opportunities and challenges for the global metals market. This move could significantly affect the U.S. metal recycling industry, supply chain stability, and the geopolitical landscape of strategic materials.

Ukraine’s Untapped Mineral Wealth

Ukraine is home to a vast array of critical minerals essential for modern industries. The country has deposits of 22 out of the 34 minerals deemed critical by the European Union, including tantalum, lithium, graphite, nickel, titanium, manganese, zirconium, and rare earth elements like neodymium and cerium. These materials are crucial in industries ranging from electronics and defense to green energy and aerospace.

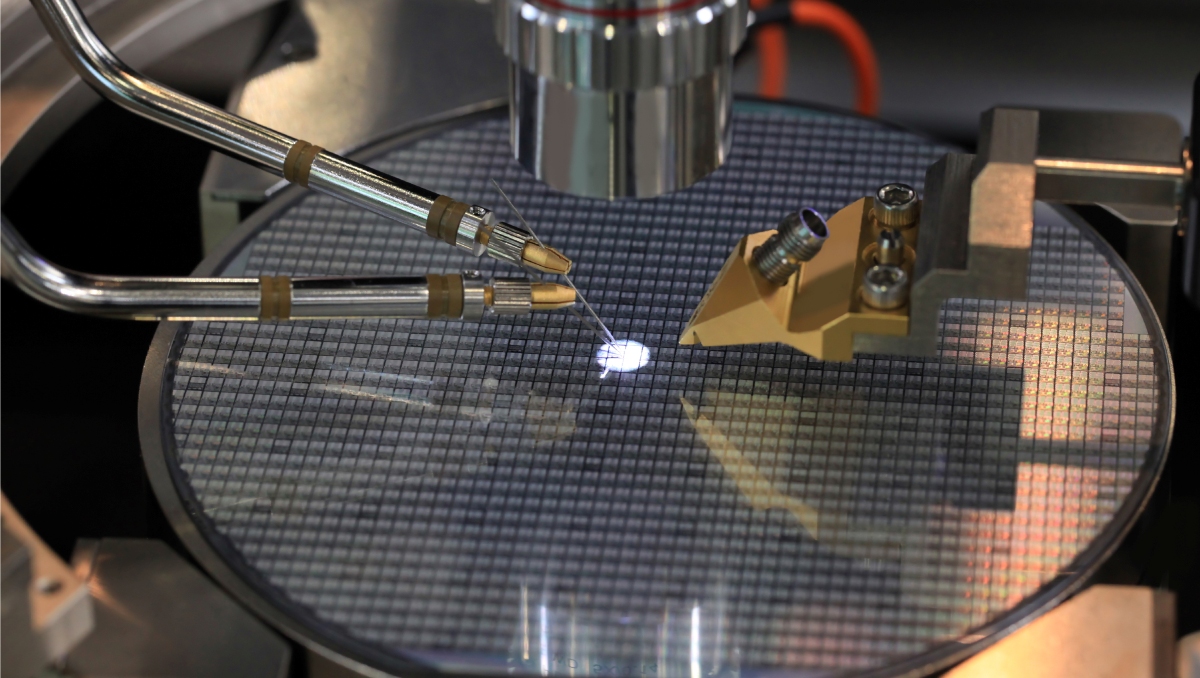

One of the most valuable minerals to consider is tantalum which is a rare, corrosion-resistant metal used in capacitors for electronics, medical devices, and aerospace applications. Currently, the U.S. depends on imports for nearly all its tantalum supply, making Ukraine an attractive alternative to reduce reliance on sources like China and the Democratic Republic of Congo.

Impact on the U.S. Metal Recycling Industry

If a deal is finalized allowing the U.S. to mine and extract minerals from Ukraine, it could have several major implications for the domestic metal recycling sector:

1. Increased Raw Material Supply Could Lower Scrap Metal Prices

One of the most immediate effects would be an increase in primary metal supply, particularly for metals like tantalum, nickel, and titanium. This could drive down the demand for recycled materials, impacting companies that rely on the sale of reclaimed metals.

Tantalum: The global tantalum supply chain currently relies heavily on recycled scrap from electronics. If Ukraine becomes a significant supplier, refiners may shift toward cheaper mined materials, reducing the incentive to recycle tantalum from old circuit boards and capacitors.

Nickel & Titanium: The aerospace and EV industries use a large portion of recycled nickel and titanium. A surge in Ukrainian mining could reduce reliance on secondary supply, affecting scrap metal prices.

2. Potential Disruption to U.S. Scrap Export Markets

The U.S. exports a significant amount of scrap metals to nations with refining capabilities, including China and European markets. If Ukrainian mining projects scale up, these countries may shift toward cheaper mined materials rather than purchasing U.S. scrap, leading to reduced export demand and downward pressure on U.S. scrap prices.

3. Strategic Reshuffling in Supply Chains

One of the benefits of Ukrainian mining for the U.S. is reducing reliance on China, which currently dominates the global rare earths and battery metal markets. However, this could also lead to geopolitical pushback from China, potentially affecting trade policies related to scrap exports.

China has, in the past, restricted rare earth exports to the U.S. in response to trade disputes. If the U.S. secures Ukrainian supply, China might impose additional tariffs or restrictions on scrap imports from the U.S., further impacting recycling firms.

4. Increased Investment in U.S. Processing Infrastructure

While the influx of Ukrainian-mined metals could challenge the recycling industry in some ways, it also presents opportunities for increased domestic processing capacity. If the U.S. gains greater access to raw materials from Ukraine, new refining and processing plants may be developed, which could create demand for secondary materials such as scrap tantalum, nickel, and titanium.

Opportunities for the Recycling Industry

Despite these potential challenges, the U.S. recycling industry could still find ways to adapt and thrive:

- Value-Added Recycling: Companies could focus on refining high-purity recycled metals rather than just raw scrap to maintain competitive pricing.

- Circular Economy Initiatives: With a greater supply of mined materials, there may be a push toward blended material use, where recycled metals are used alongside virgin materials in manufacturing.

- New Regulations & Subsidies: The U.S. government may introduce policies encouraging the continued recycling of critical minerals, similar to tax credits or incentives for EV battery recycling.

If the U.S. secures access to Ukraine’s mineral resources, the metal supply chain will be fundamentally altered, impacting prices, trade flows, and recycling incentives. While lower scrap metal prices and reduced export demand pose challenges for recyclers, opportunities exist in high-value processing and domestic infrastructure development.

The shift toward Ukrainian mining could redefine how the U.S. approaches its strategic metal reserves, recycling policies, and overall industrial supply chain resilience in the coming years. For companies in the metal recycling industry, adaptation will be key to staying competitive in a rapidly evolving market.