Precious Metal Prices Decline After 2024 Election

Date

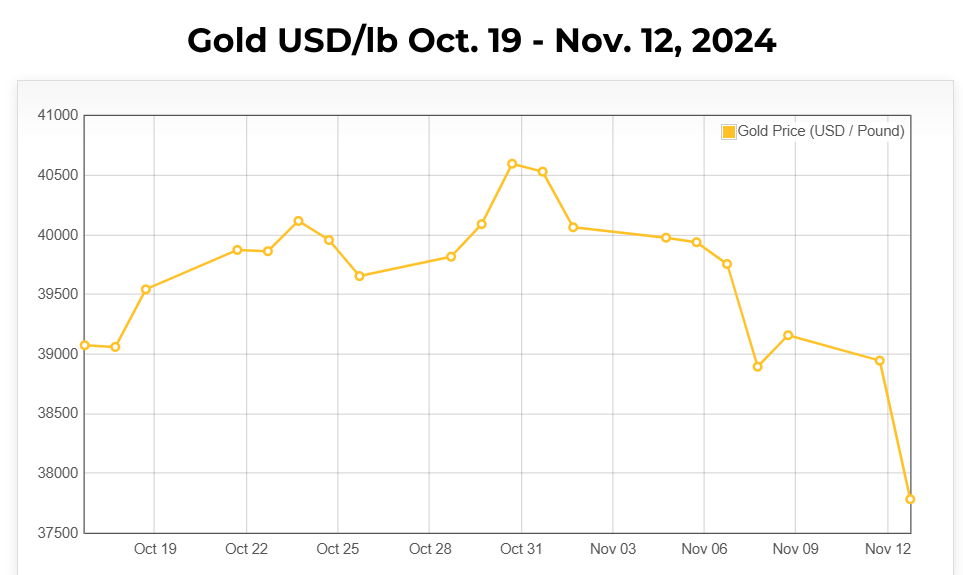

USD-Price Of Gold(au) per pound November 2024.

Source: www.DailyMetalPrice.com

The Impact of Falling Precious Metal Prices

Following the 2024 U.S. presidential election, shifts in economic sentiment have led to a decline in the prices of precious metals. This post-election trend reflects the economic adjustments typically observed after major political events. Several metals, including gold, tantalum, stainless steel, platinum, and hafnium, have experienced price decreases as investors adjust portfolios and the economic outlook improves.

Reasons Behind the Decline in Precious Metal Prices

Political stability often prompts investors to shift funds from precious metals, traditionally viewed as safe-haven assets, into equities and other riskier options. This shift has dampened demand for precious metals, leading to a decrease in their value. The U.S. dollar’s strength following the election has compounded this effect, making dollar-denominated metals more expensive for international buyers and further reducing demand.

Additionally, the Federal Reserve’s anticipated approach to inflation and interest rates is another key factor. With expectations of stable or rising interest rates, the appeal of non-yielding assets like gold and platinum diminishes, contributing to their price decline. The precious metals market, particularly for assets like gold, platinum, and tantalum, has reacted to this broader economic shift.

Price Movements for Key Metals

According to Daily Metal Price pricing charts, Gold is currently trading around $1,750 per ounce as of mid-November 2024, reflecting a notable reduction from its pre-election levels. Platinum has also experienced a decline, with its price now around $900 per ounce. Tantalum, which is closely tied to demand in the technology sector, has seen a modest price dip as adjustments in consumer electronics affect its market. Stainless steel, often used in industrial applications, is trading at $449.59 per metric ton. Hafnium, used primarily in aerospace and nuclear industries, has experienced a small price drop and is currently priced at $4,472.71 per kilogram – (Strategic Metals Invest).

How Precious Metal Recyclers Are Impacted

For precious metal recyclers, these price declines present a mix of challenges and potential opportunities. The immediate impact is on revenue; with lower prices for metals like gold and platinum, recyclers earn less per unit, tightening profit margins. Reduced prices for high-value metals can make operations less profitable, particularly for recyclers heavily dependent on precious metal recovery.

Adjusting Operations to Navigate Market Changes

With prices expected to remain low, recyclers may consider operational adjustments. By shifting focus to metals with steadier prices or exploring cost-saving measures, recyclers can manage some of the revenue impact. Additionally, recycling remains a cost-effective alternative to primary metal production, which may increase the volume of materials available for recyclers as companies opt for recycling over new production.

Emphasizing ESG and Sustainability for Industry Resilience

The environmental, social, and governance (ESG) principles that drive many corporations today are creating additional incentives for recycling. Regardless of metal prices, companies and consumers increasingly prefer recycling for its lower environmental impact. According to MGS Refining, “As ESG principles gain traction, recyclers can play an essential role in promoting sustainable practices, even during market downturns” .

The Future Outlook for Metal Recycling

While lower precious metal prices may reduce short-term revenue, the recycling industry’s resilience and adaptability remain strong. Diversifying sources, enhancing recycling efficiencies, and emphasizing green marketing can help recyclers maintain their market relevance. By remaining flexible and attuned to industry trends, metal recyclers can continue to support sustainable practices and meet demand in a changing economic environment.