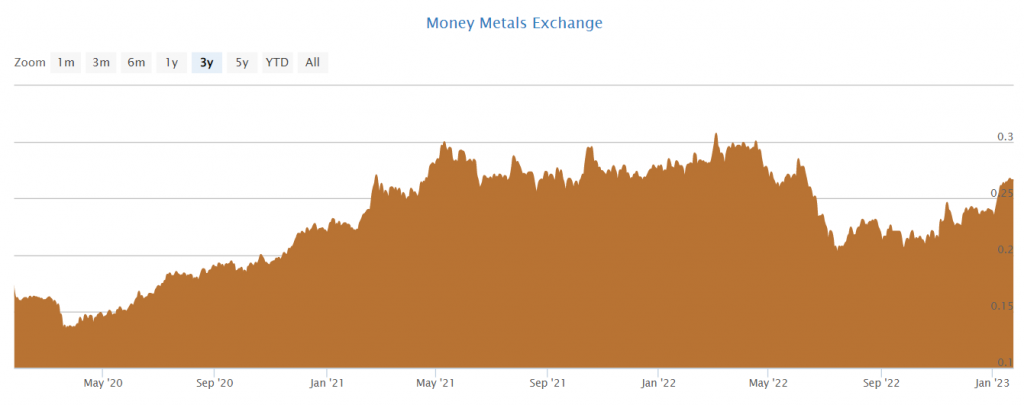

The Rising Price Of Copper

Date

The rising price of copper is a complex issue that is influenced by a variety of factors, including increased demand, supply chain disruptions, and currency fluctuations. Copper is a widely used metal that has a wide range of industrial applications, including electrical wiring, construction, and transportation. It is often referred to as the “bellwether of the global economy” because of its extensive use in various industries and its correlation with economic growth.

One of the main drivers of the rising price of copper is increased demand from developing countries, particularly China. As these countries continue to industrialize and urbanize, their need for copper in construction and transportation projects has grown. Additionally, the shift towards renewable energy sources such as wind and solar power has also led to an increase in demand for copper, as it is a key component in many electrical systems. The increased adoption of electric vehicles (EVs) also drives the demand for copper, as each EV requires four times more copper than a traditional gasoline-powered car. With governments around the world pushing for cleaner energy and alternative modes of transportation, the demand for copper is expected to continue to grow in the coming years.

Another factor contributing to the rising price of copper is supply chain disruptions. The pandemic has caused a slowdown in mining and manufacturing operations, leading to a decrease in the supply of copper. Furthermore, many mines have been forced to close or operate at reduced capacity due to health and safety measures, which has further impacted the supply of copper. The natural disasters, labor strikes, and geopolitical risks also play a role in disrupting the copper supply chain and pushing the prices upward.

Currency fluctuations have also played a role in the rising price of copper. As the U.S. dollar has weakened, it has made copper more expensive for countries that import the metal. This has led to increased demand for copper, as well as higher prices. The fluctuation in the value of the dollar also affects the mining companies’ revenues and profits, as they earn their income in local currency but have to pay their expenses in dollars.

Despite the rising price of copper, it is still considered a relatively affordable metal compared to other metals such as gold and silver. However, it is important to note that the rising price of copper can have a significant impact on industries that rely on the metal, such as construction and manufacturing. As a result, companies in these industries may need to adjust their operations and pricing to accommodate the higher costs of copper. This, in turn, can lead to inflation and affect the overall economy.

In conclusion, the rising price of copper is a multifaceted issue that is influenced by both internal and external factors. The increasing demand, supply chain disruptions, and currency fluctuations are all contributing to the upward trend of copper prices. While it may present challenges for certain industries, it is also an indicator of the growing global economy and increasing demand for copper in various applications. It is important for industries to stay informed and adapt their strategies accordingly to navigate the changing market conditions.