The Most Precious Of All Precious Metals

Date

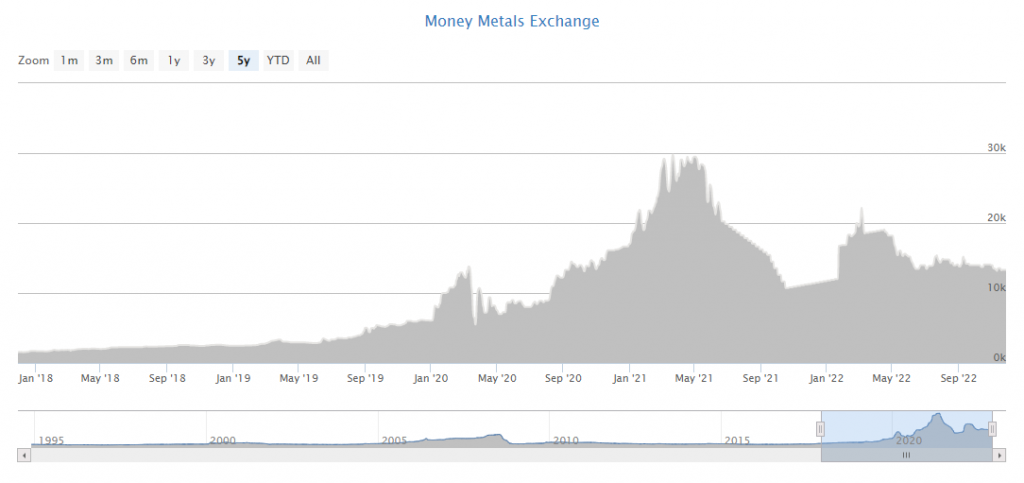

Iridium, Rhodium, Osmium, Palladium, Ruthenium, and Platinum are the 6 elements comprising the PGM(Precious Metals Group). Starting in the last quarter of 2019, the price per ounce of Rhodium began to skyrocket when compared to the other metals classified within the PGM(Precious Metals Group). Today, Rhodium is considered the most valuable precious metal on the market.

Origins of Rhodium

The name Rhodium comes from the Greek word “Rhodon,” meaning rose, named for the rose-red color of its salts. Rhodium was discovered in 1803 by William Hyde Wollaston. During a joint venture with an English chemist and colleague – Smithson Tennant, the duo attempted to produce pure Platinum for commercial purposes. In order to do so, the Platinum originating from a source in South America had to undergo a process called “aqua regia” (nitric acid + hydrochloric acid) which dissolves the Platinum into solution.

Elements including osmium and iridium were noticed by Tennant within the dissolved metal solution but Wollaston was more focused on the residues left-over from the dissolved solutions. After breaking down the left-over residue, Wollaston concentrated on the solution of dissolved platinum which also contained Palladium. He isolated and then produced a sample of the metals through methods of precipitation. He took note of the red solution from which he then derived dazzling red crystal structures and further developed into a sample of the metal Rhodium itself.

Rhodium’s Preciousness

According to the Royal Society Of Chemistry, Rhodium can be found in nature in both combined with Platinum and although fine and very rare, it can be found uncombined or by itself mixed into sands of shores stretching from South America through North America. For commercial production of Rhodium, it is typically made as a by-product of Nickel and Copper refinement. Rhodium’s demand is fueled from the automotive sector of the economy. 80% of all Rhodium produced is used by automobiles to help remove dangerous gases from the tailpipes of fossil-fuel burning vehicles. The remaining 20% is needed across industries such as electrical, chemistry and medical for a variety of applications such as an alloy in pacemakers. According to Lenntech Rhodium is commonly used “in furnace windings, pen nibs, phonograph needles, high-temperature thermocouple and resistance wires, electrodes for aircraft spark plugs, bearings and electrical contacts”.

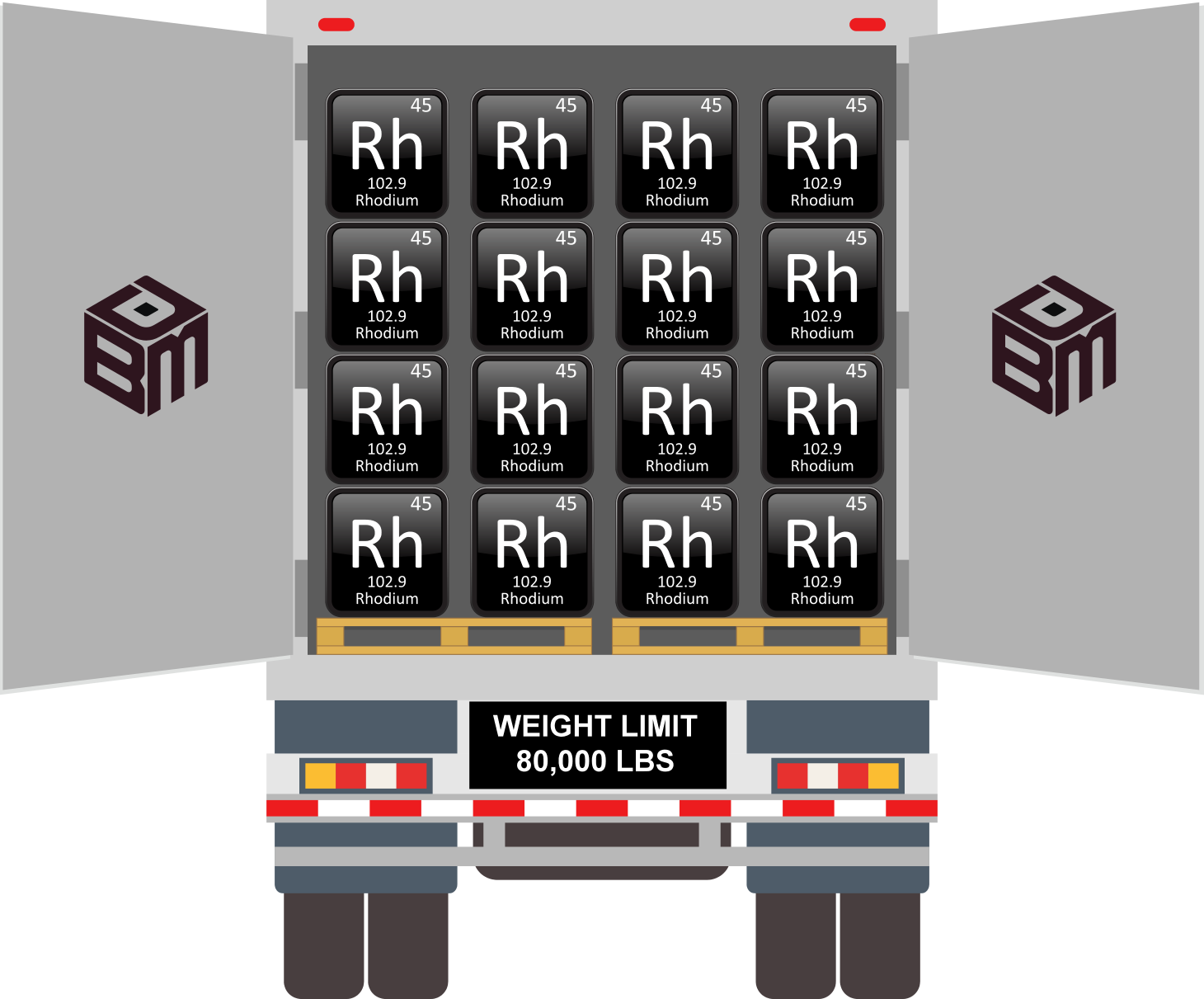

What makes Rhodium so precious is its rarity and therefore so valuable. As of September 2022 the cost for an ounce of Rhodium was steady at around $13,300. Current mining and production efforts produce about 32 Tonnes of Rhodium annually. This is just under the weight limit of a tractor trailer. In other words, the annual amount of Rhodium produced for commercial purposes worldwide could fit onto the back of a single tractor-trailer truck.

The Future Of Rhodium

Rhodium’s preciousness is derived from its scarcity. However, current market trends may not hold due to the rise in popularity of electrical vehicles which do not require rhodium to clean tailpipe emissions. This means the monetary value of Rhodium could see a decrease in the next few years as Rhodium’s demand gradually declines in line with the phasing out of gas powered vehicles. Although the market size for Rhodium is very small, it’s safe to say that as an investment, it is one that is optimistic yet volatile.

Given the wide range of applications Rhodium is used for, it will likely be in demand for many years to come. Given the scarcity of the precious metal, it may experience a decline in value but it will not become worthless monetarily overnight. Currently demand far exceeds supply but the market for Rhodium is small and can be expected to adjust quickly to dips in demand while retaining value. As a major recycler of Rhodium, D Block Metals remains dedicated to sourcing and supplying Rhodium responsibly worldwide.