Palladium’s Popularity

Date

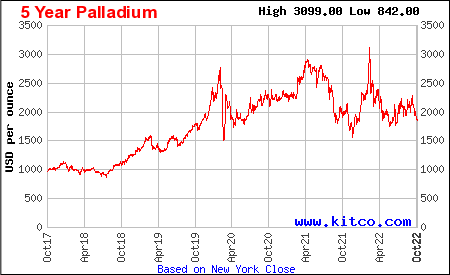

As the demand for Palladium increases, this valuable and highly versatile cousin of Platinum has been proven to rival the value of Gold. Palladium is used across a variety of industries such as automotive, jewelry, and electronics just to name a few. With the price of Palladium reaching an all-time high of $3,099USD per ounce in March 2022 and global demand over 3 times greater than it was in 1990; Palladium is currently(October 2022) being traded at higher prices than Gold within commodity markets around the world.

Origins

Palladium was accidentally discovered in 1802 by a chemist named William Hyde Wollatson. During an experiment, Wollatson mixed nitric-acid together with hydrochloric acid(a mixture now known as “agua regia”). The element resulting from the mixture was observed and named Palladium after the asteroid “Pallas”. Instead of reporting his findings to the scientific community, Wollatson decided to keep his discovery to himself by selling it as an alternative choice to silver jewelry. Wollatson was eventually pressured by his peer – Richard Chenevix to report his findings to the scientific community. Shortly after its discovery, Palladium was used to treat Tuberculosis but undesirable side effects caused it to quickly fall out of favor with the medical community. It wasn’t until 1990 that Palladium’s popularity resurfaced along with the advent of catalytic converters in the automotive industry.

Industrial Applications

The highest demand for Palladium is seen from the automotive industry. Most of all Palladium processed goes into every gas or diesel powered car’s tail pipe. Every car you see on the road meeting federal emissions requirements is equipped with a catalytic converter. Catalytic converters rely on Palladium to convert harmful gases such as hydrocarbons, nitrogen dioxide and carbon monoxide into more environmentally friendly elements such as carbon dioxide, water, and nitrogen. However, Palladium’s popularity may soon see a sharp decrease in demand as electric vehicles do not require catalytic converters.

According to Reuters, automotive manufacturers consume “80% of the 10 million ounces of Palladium used each year”. The remaining 2 million ounces are primarily used to make jewelry, multi-layer capacitors, hydrogen production, hydrogen storage, fillings for tooth decay and printing for photography.

Future Of Palladium

Like most precious metals, Palladium’s value changes daily. The three main influences on the price of Palladium are 1) demand from the auto-industry 2) mining production, and 3) supply chain performance. In 2021, Palladium started to see a decrease in demand from the automotive industry as production of new vehicles slowed in tandem with the Covid-19 pandemic. This decline in demand is forecasted to be reversed as auto production returns to normal levels in 2022. The 4 main countries producing Palladium are Russia(44%), South Africa(40%), United States(7%) & Canada( 5%). The remaining sources of Palladium are mined elsewhere in countries such as Zimbabwe. Since natural sources of Palladium are limited to these locations, the health of ongoing operations of Palladium mines is vital to meet global demands. However, all the Palladium in the world is worth nothing unless it is allocated appropriately. Supply chain issues such as the computer chip shortage during the Covid-19 pandemic can force manufacturers to consider alternative metals such as Silver or Platinum. As an industrial commodity, Palladium is a much riskier investment than other precious metals such as Gold. Currently, the value of Palladium is experiencing all time highs but fundamental changes in automotive manufacturing may soon cause a global surplus of Palladium thus decreasing its value. The future of Palladium’s popularity is somewhat unpredictable but as a major recycler of Palladium, D Block Metals remains dedicated to meeting the supply needs demanded by manufacturers around the world.