The Soaring Demand For Lithium

Date

Lithium is a highly flammable and reactive soft-metal that is quickly becoming one of hottest commodities around the world. It is commonly used to manufacture medicines, ceramics, e-cigarettes, e-bikes, cellphones, and a variety of other electronic devices. However, the primary driver behind the soaring cost of Lithium comes from the automotive industry. EV’s(electric vehicles) are reliant upon Lithium batteries as a power source. In 2021 the production of EV’s rose by 21% in comparison to 2020. According to Benchmark Minerals, the cost of Lithium carbonate used in the process of manufacturing EV’s batteries increased from $6,128 in August 2020 to $59,928 per metric ton.

Demand

The sudden demand for Lithium at current prices has dubbed it the nickname “white-gold” in lieu of the famous California Gold Rush of 1848. As global environmental efforts attempt to phase out the internal combustion engine, Lithium powered EV’s are being widely accepted as the next standard mode of transportation. According to the EPA, “Greenhouse Gas (GHG) emissions from transportation account for about 27 percent of total U.S. greenhouse gas emissions, making it the largest contributor of U.S. GHG emissions”. Of that 27%, roughly 16% comes from passenger vehicles. Reducing overall GHG emissions by 16% nationwide by replacing internal combustion engines with electrically powered engines producing 0 GHG emissions is important for our environment and therefore inherently important to everyone on the planet.

Supply

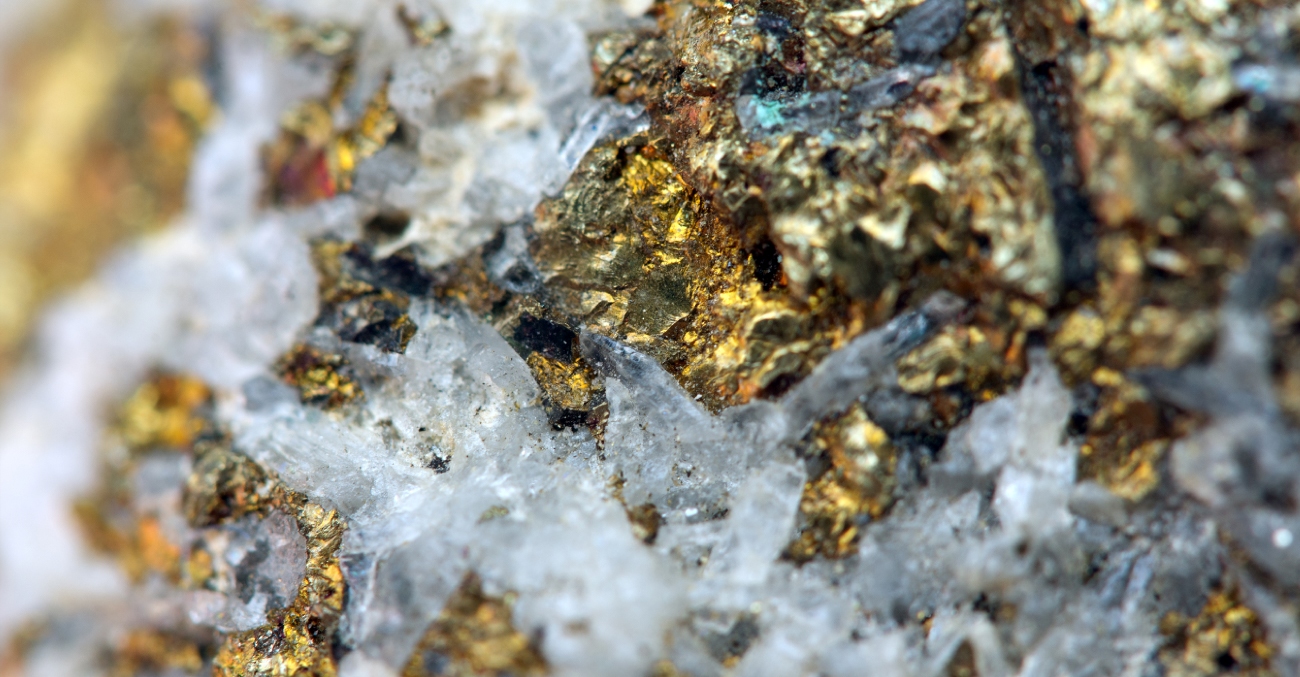

The world’s largest supplier of Lithium is Australia followed by China, Argentina, and Chile. The price of Lithium increased to all time highs in 2021 and continues to remain strong through Q4 2022. Demand currently far exceeds supply globally. However, there is no shortage of Lithium in the earth. Lithium is primarily mined from Rock & Brine Pools. Setting up a Lithium mine can take about 3-5 years before it is operating smoothly. Therefore, the supply deficits we are seeing today should be less apparent by 2026 once mineral suppliers have had enough time to adjust for the sudden influx of demand by the automotive industry.

Future

The IEA(International Energy Agency) predicts that Lithium supply will triple by 2025. The main factor driving demand for Lithium will come from the automotive industry. The recent sharp increase in demand for Lithium is being fueled by a worldwide collective effort to ensure a healthier environment for everyone to enjoy. Only time will tell but with rumors of trains, airplanes, buses, pipelines, and trucks to follow suit, the demand for Lithium is only expected to increase for years to come.