The Surging Prices of Hafnium

Date

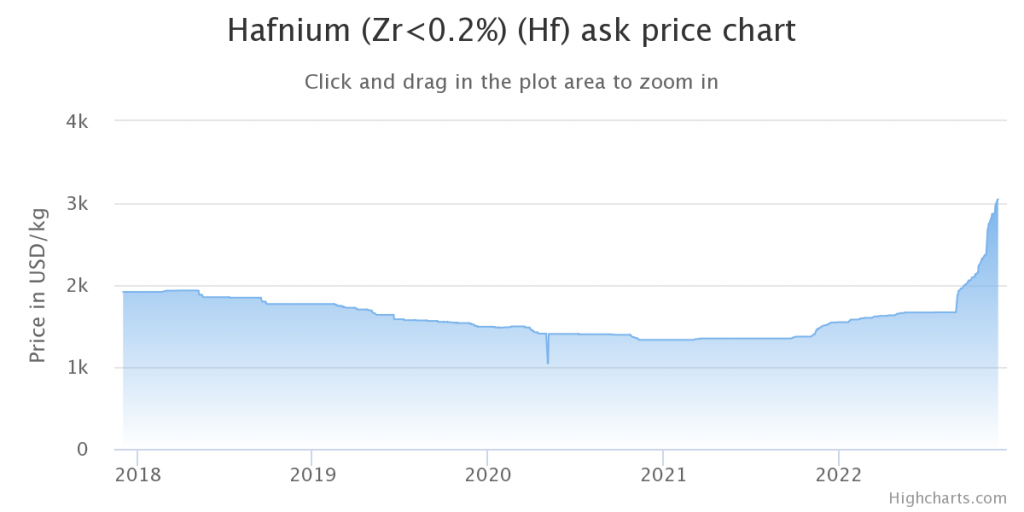

Hafnium has enjoyed a significant uptick in recent years. Characterized by its silver luster, ductility, and resistance to corrosion, a multifarious array of industries are making good use of the element, with applications ranging from nuclear plants, the aerospace industry, microelectronics, and more. Unfortunately, the increase in popularity combined with a relative shortage has resulted in a disparity between supply and demand, which has in turn driven the price of hafnium to an all-time high. Hafnium costs a consumer a conservative $1,632.40 per kilogram at the start of 2022. As of November 2022, the price has skyrocketed to a whopping $3,136.10 for the same amount.

Purposes For Hafnium

Hafnium has a variety of uses across various industries, including:

• Nuclear plants: Hafnium absorbs high levels of radiation, making it an ideal material for use in control rods inside nuclear reactors.

• Aerospace industry: Engineers employ hafnium in the construction of jet engines and spacecraft due to its high melting point and resistance to corrosion.

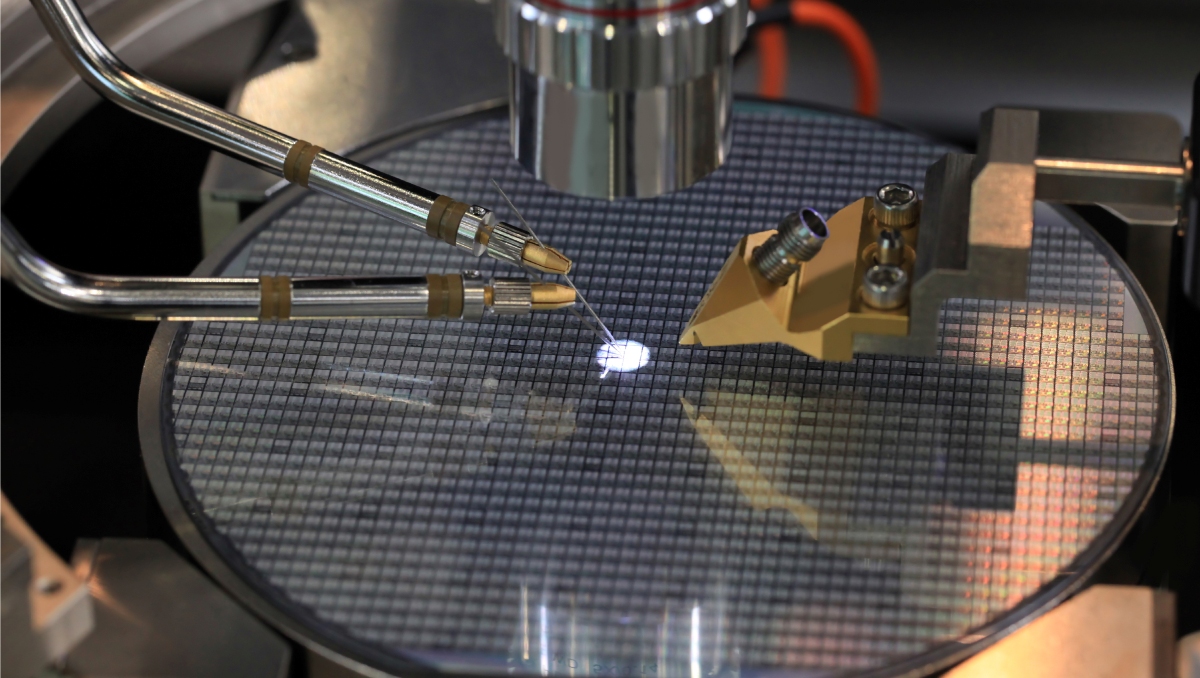

• Microelectronics: Hafnium oxide is used as a dielectric material in microelectronics. Most notably, the gargantuan tech corporation Intel utilizes hafnium in the creation of their famed Pentium processors, as it increases heat resistance of these all-essential computer components.

• Chemical industry: This industry uses Hafnium as a catalyst, often in the production of ammonia and other chemicals.

Hafnium does have miscellaneous uses in other industries. For example, anti-reflective coated glass for eyeglasses and camera lenses.

The Future Of Hafnium

Because Hafnium has a wide array of applications and is becoming increasingly rare in supply, the market price has increased steadily over the past five years until 2022 when it surged by 123.32%. Hafnium’s current price marks the highest it has been since 2017, and it’s only expected to continue this trend into the coming years. This is mostly thanks to hafnium’s prevalence in the aerospace industry and in the creation of Intel Pentium processors are poised to continue growing over the next 10 to 20 years. Because of this, it is feasible that the price of hafnium will rise commensurately. Hafnium usage in the nuclear industry, however, is expected to remain static or decrease as the global push toward greener energy alternatives gains traction.

The Effects Of Surging Hafnium Prices

Market participants are now exploring alternatives to Hafnium use to mitigate the overall cost of production. Super-alloys using lower quantities of Hafnium and larger concentrations of Rhenium are one viable alternative. How Hafnium is used will dictate the feasibility of using Rhenium however, in less critical applications like industrial gas turbines; manufacturers are able to quickly replace Hafnium with Rhenium without compromising the integrity of the final product. In aerospace applications, on the other hand, it’s not as clear cut. Rhenium enjoyed similar prevalence in 2008 until the aerospace industry pushed for greater recovery rates and recycling for maximum retention of valuable resources. It seems again, a push for greater recycling will be imperative for manufacturers to continue using hafnium without driving the price point to astronomical heights. While economical alternatives to hafnium might be on the horizon, metal recycling very well could be the best immediate solution to ameliorate the negative effects of Hafnium’s surging price.