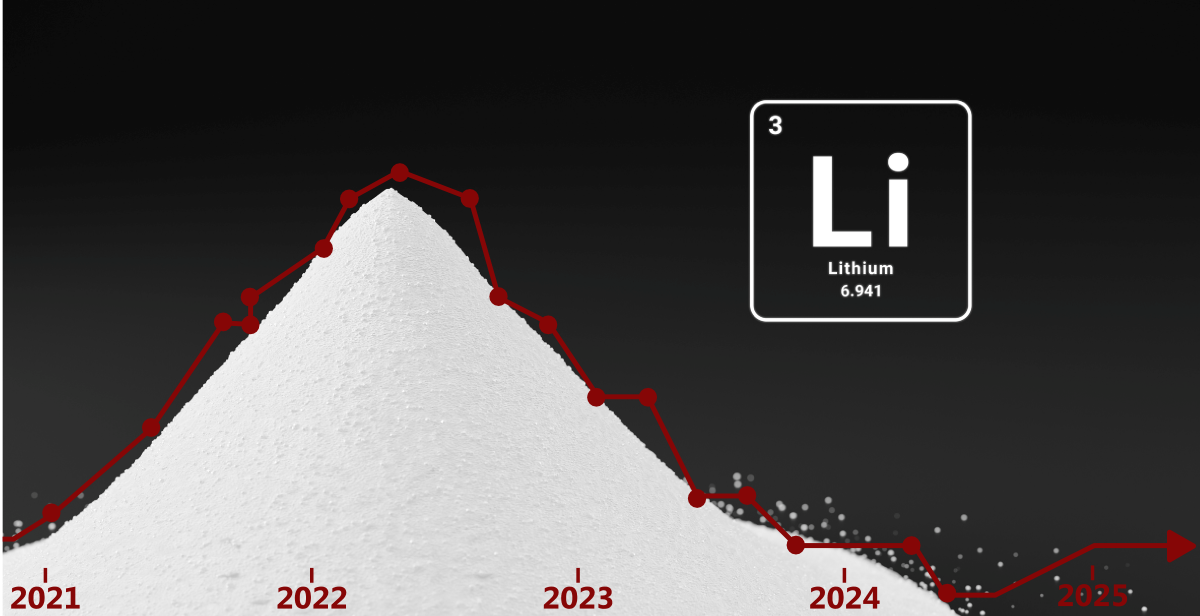

Lithium Hydroxide and Lithium Carbonate Prices Plummet

Date

Lithium hydroxide and lithium carbonate prices decreased in value by more than 80% during 2023 and 2024.Source: www.TradingEconomics.com

Understanding the 80% Decline Of Lithium

In opposition to our October, 2022 article on Lithium’s “soaring demand”, the prices of lithium hydroxide and lithium carbonate, essential materials for lithium-ion batteries, have fallen by more than 80% throughout 2023 and into 2024. These materials, once in high demand due to the booming electric vehicle (EV) market, are now facing a very different market dynamic. Here is an explanation of the factors contributing to this dramatic price decline.

Oversupply from Expanded Production

One of the primary reasons for the price drop is an oversupply of lithium. Over the past few years, countries such as Australia, Chile, and China expanded mining operations significantly, expecting continued growth in battery demand. However, demand did not grow as quickly as anticipated. This oversupply resulted in a surplus of lithium on the market, putting downward pressure on prices.

Advances in Lithium Extraction Technology

Technological advancements have made lithium extraction more efficient, reducing costs and increasing availability. Methods such as direct lithium extraction (DLE) allow for faster and more sustainable lithium production from brine sources. Additionally, recycling initiatives for lithium-ion batteries have begun to recover usable lithium, further adding to the global supply.

Slowing Demand for Lithium-Ion Batteries

The demand for lithium-ion batteries has not grown as expected in recent years. Economic uncertainty, rising interest rates, and reduced consumer spending have contributed to slower EV adoption in key markets like Europe and North America. In China, reduced government subsidies for EVs have also impacted the market, leading to a decline in battery demand. Additionally, some manufacturers are exploring alternative battery chemistries that rely less on lithium, such as sodium-ion and solid-state batteries.

Speculative Bubble and Market Correction

The sharp rise in lithium prices during 2021 and 2022 was fueled in part by speculation. Investors and producers bet heavily on the continued growth of EVs, which drove prices to unsustainable levels. As supply increased and demand slowed, the speculative bubble burst, leading to the steep price correction seen throughout 2023 and 2024.

Economic and Geopolitical Factors

Global economic conditions have also played a role in the decline. Higher interest rates have made financing EV purchases more expensive, slowing adoption. Inflation and recession fears have reduced consumer confidence and spending, while ongoing trade tensions, particularly between the United States and China, have created uncertainties in the supply chain.

What This Means for the Industry

The drop in lithium prices presents both challenges and opportunities. EV manufacturers and battery producers may benefit from lower raw material costs, potentially lowering the price of EVs for consumers. However, high-cost lithium producers may struggle to remain profitable and could scale back operations or delay planned expansions.

While the current oversupply has created short-term instability, the long-term demand for lithium remains strong as the world transitions to renewable energy and electrified transportation. Balancing supply and demand will be critical for stabilizing the market in the years ahead.

At D Block Metals, we are committed to helping businesses navigate the complexities of the metals market. Whether you are involved in EV production, battery manufacturing, or metal recycling, our team is here to provide expert guidance tailored to your needs.